Get Currencies, Metals and Commodities Trade Signals, Analysis, Recommendations, Key Levels, Fund management, Broker Recommendation.

Monday, September 2, 2013

GBPJPY PRICE ACTION: Closing price Reversal Update.

When I ran a commentary on this pair August 29, I did point out that the pair was expected to remain bullish and expected to aim towards 154 - 155 resistance zone. Price has now got there.

Subscribe to my Trade Room or my Mentor Programme or my Price Action Course to experience the simplicity of trading Price Action with me.

Saturday, August 31, 2013

USDJPY PRICE ACTION: Inside Bar Trade Setup.

Subscribe to my Trade Room or my Mentor Programme or my Price Action Course to experience the simplicity of trading Price Action with me.

Thursday, August 29, 2013

GBPJPY PRICE ACTION: Closing Price Reversal Trade Setup pulls higher, August 29, 2013.

GBPJPY today, has pulled higher after the pair gave off a Closing Price Reversal (CPR) Trade Setup at the close of trading yesterday. It is expected still that the pair would aim to reach the 154-155 psychological resistance zones therefore, we will remain bullish on this pair yet.

Subscribe to my Trade Room or my Mentor Programme or my Price Action Course to experience the simplicity of trading Price Action with me.

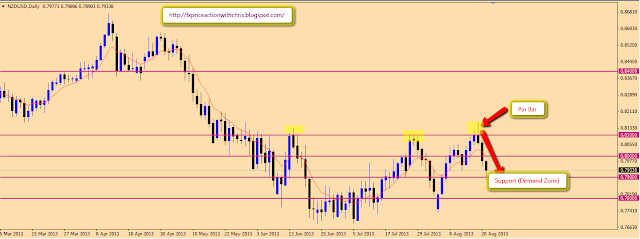

NZDUSD UPDATE: Bearish Pin Bar Trade Setup August 29, 2013

The Kiwi has been on a free fall since we discussed its Pin bar Price Action Trade Setup on August 19. It seemed to have hit a halt after yesterday's Pin bar but it should be noted that the pin bar Closed below the Psychological resistance hence, price was quickly rejected as it approached the dynamic resistance. The trade room quickly went short as soon as the day closed with price expected to reach for the next psychological support at 0.7700.

Subscribe to my Trade Room or my Mentor Programme or my Price Action Course to experience the simplicity of trading Price Action with me.

Wednesday, August 21, 2013

CHFJPY PRICE ACTION: Counter Trend Pin bar at Resistance. August 21, 2013

We have what looks like a straight forward bearish setup on the CHFJPY after price gave off a false break of its Psychological resistance. The lower time frames have also shown a breakout, therefore the pair is expected to resume its fall. If the expected sell-off manages to close below its support zone, we would see a much more intensive fall. Supports beyond the Support zones are seen at 104.00, followed by the 103.00 psychological level.

Subscribe to my Trade Room or my Mentor Programme or my Price Action Course to experience the simplicity of trading Price Action with me.

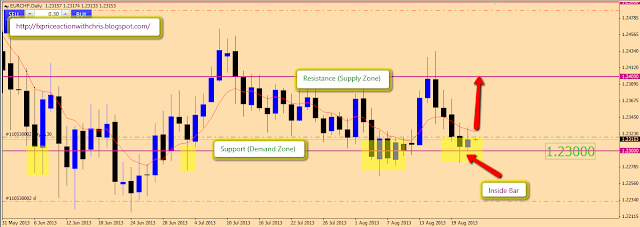

EURCHF PRICE ACTION: Counter Trend Inside Bar Bar at Support. August 21, 2013

An inside bar when it occurs usually alerts to indecisiveness in the market, so could act both as a trend changer or continuation, depending at what stage of the market it is found. In the EURCHF today, we have an Inside Bar trade Setup, just above Support. Before the formation of the inside bar, price had only been able to pierce the 1.2300 psychological support, closing above it eventually. Today, price has also closed above this level and we also have seen a minor breakout in the lower time frames (Which is where we determine whether an entry could be made or not). This points to bullish expectations for the rest of the week and if the setup pulls off, the 1.2400 Resistance (Supply Zone) may not be able to hold the thrust.

Subscribe to my Trade Room or my Mentor Programme or my Price Action Course to experience the simplicity of trading Price Action with me.

NZDUSD UPDATE: Bearish Pin Bar Trade Setup hits support August 21, 2013

Following the Pin Bar Trade Setup on the NZDUSD, which we have been following and subsequently traded after the break of Support, the pair has hit the projected psychological support area and our TP. It remains to be seen if the day will end with this rejection. If it does and we close the day with a Pin bar, We may then look to trade the new Setup.

Subscribe to:

Posts (Atom)