GBPNZD broke below support as iit pulled lower. This break is expected to play out as a false break therefore, traders would be looking to fade the break. At the moment, the expected bullishness is supported by friday's candle close. The bullish trigger should be traded when it appears withing the week.

AUDCHF should remain bearish in the new week after we saw price rotate higher most of last week.

EURGBP has continued to pull higher after a bullish trigger was spotted within the previous week.As price now approaches the resistance zone, we would wait to see if the more dominant bearish trend would continue.

GBPAUD is within its support zone and the pair could pull higher within the week/month. We however, still will be on the look out for a valid trigger setup.

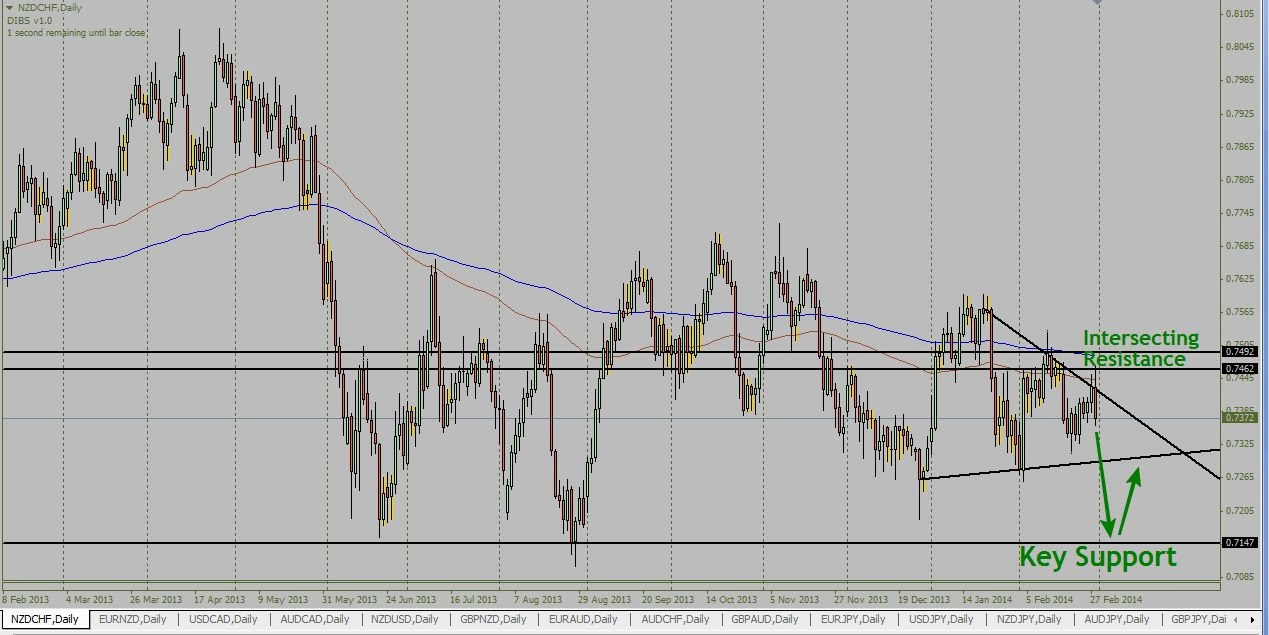

NZDCHF had been expected to be bearish in the previous week but price traded higher instead. However, the pair still carries a bearish bias and ma have resumed its selloff as a result of the Pin bar seen on t=Thursday 6th March.

Take advantage of my promotional 50% price Slash to enroll for my Price Action Course or a free Subscription to my Trade Room or Mentor Programme to experience the simplicity of trading Price Action with me.

Free Signal Service:

Fee: $0

Duration: for life

send me an email for detail on this

ahizechris@gmail.com

or skype :christian.ahize

Get Currencies, Metals and Commodities Trade Signals, Analysis, Recommendations, Key Levels, Fund management, Broker Recommendation.

Showing posts with label NZDCHF. Show all posts

Showing posts with label NZDCHF. Show all posts

Sunday, March 9, 2014

Sunday, March 2, 2014

Markets Price Action and Trade Setups: THE WEEK AHEAD March 03 - March 07, 2014. EURGBP, NZDCHF, GBPCAD, AUDNZD,

NZDCHF pulled back into its intersecting resistance as price was pushed lower as it made an attempt to break through trendline/horizontal resistance. The resulting engulfing bar is a trigger for more bearishness to follow in the coming week.

Last month's analysis on the AUDNZD showed we had a bearish bias, following the Pin Bar that signalled a possible return of the bears. The trade did take a while to get going but eventually did when we got the trigger setup as shown above. This trade has hit our 1st TP and now approaches the 2nd and 3rd TP's. Tis trade could deliver well over 1000pips based on the 3 entries we made.

EURGBP looks set to resume long on a retracement move. The resistance as shown above could be key. We would watch to see if we would get a bearish trigger at that zone.

GBPCAD also looks set to retrace lower. New bullish setups would be sort at about the support as indicated above.

Take advantage of my promotional 50% price Slash to enroll for my Price Action Course or a free Subscription to my Trade Room or Mentor Programme to experience the simplicity of trading Price Action with me.

Free Signal Service:

Fee: $0

Duration: for life

send me an email for detail on this

ahizechris@gmail.com

or skype :christian.ahize

Last month's analysis on the AUDNZD showed we had a bearish bias, following the Pin Bar that signalled a possible return of the bears. The trade did take a while to get going but eventually did when we got the trigger setup as shown above. This trade has hit our 1st TP and now approaches the 2nd and 3rd TP's. Tis trade could deliver well over 1000pips based on the 3 entries we made.

EURGBP looks set to resume long on a retracement move. The resistance as shown above could be key. We would watch to see if we would get a bearish trigger at that zone.

GBPCAD also looks set to retrace lower. New bullish setups would be sort at about the support as indicated above.

Take advantage of my promotional 50% price Slash to enroll for my Price Action Course or a free Subscription to my Trade Room or Mentor Programme to experience the simplicity of trading Price Action with me.

Free Signal Service:

Fee: $0

Duration: for life

send me an email for detail on this

ahizechris@gmail.com

or skype :christian.ahize

Sunday, January 26, 2014

Markets Price Action and Formations: THE WEEK AHEAD JAN 27 - 31 2014. EURJPY EURNZD GBPCHF GBPJPY NZDCHF NZDUSD

EURJPY appears to be offloading some of its over bought pressure. It is important to note that the recent rally of the jpy could even get stronger given that the move has triggered from a head and shoulder formation. We are yet to get a confirmatory price action confirmatory setup to go with the formation and if we fail to get it until price hits the horizontal/trendline support, the more dominant bullish trend should then continue.

Last week, I had mentioned that the EURNZD was still within its bullish trend as price fell into its bullish entry zone. The trade room made bullish entries based on the setup and we are currently over 300pips up as we approach our conservative TP.

GBPCHF has just broken through our bullish trendlines as its corrective sell-off seem to be flagging a change in trend. However, we wont be moved into any actions on this pair just yet until the trend clears out. We still carry a bullish bias on this pair as we wait for prices to offer opportunities to trade into them.

The NZDCHF has continued in its more dominant bearish trend after a corrective sell-off on the head and shoulder price formation as indicated above. Price on this pair should continue to fall lower in the coming week

NZDUSD is trapped within a range but has been offering reasonable trade setups in the range. At the moment, we still await a bullish entry setup from the head and shoulder formed at range support.

Take advantage of my promotional 50% price Slash to enroll for my Price Action Course or a free Subscription to my Trade Room or Mentor Programme to experience the simplicity of trading Price Action with me.

Free Signal Service:

Fee: $0

Duration: for life

send me an email for detail on this

ahizechris@gmail.com

or skype :christian.ahize

Last week, I had mentioned that the EURNZD was still within its bullish trend as price fell into its bullish entry zone. The trade room made bullish entries based on the setup and we are currently over 300pips up as we approach our conservative TP.

The NZDCHF has continued in its more dominant bearish trend after a corrective sell-off on the head and shoulder price formation as indicated above. Price on this pair should continue to fall lower in the coming week

NZDUSD is trapped within a range but has been offering reasonable trade setups in the range. At the moment, we still await a bullish entry setup from the head and shoulder formed at range support.

Take advantage of my promotional 50% price Slash to enroll for my Price Action Course or a free Subscription to my Trade Room or Mentor Programme to experience the simplicity of trading Price Action with me.

Free Signal Service:

Fee: $0

Duration: for life

send me an email for detail on this

ahizechris@gmail.com

or skype :christian.ahize

Sunday, December 8, 2013

Markets Price Action and Formations: THE WEEK AHEAD DEC 9 - 13, 2013. CADCHF EURNZD EURUSD NZDCHF NZDJPY

CADCHF has continued to move southwards inline with its recent trend. I have taken time to give a slightly different insight into what the markets are doing with respect to Price Formations. The head and shoulder Price formation which I also like a lot seem to have triggered the recent bearishness.

EURNZD has shown a reluctance for the recent bullishness to continue. We now have a the formation of a head and shoulder, with the second shoulder showing Pin bar rejection candles. It this setup pulls off, it still could be contained within the symmetric triangle formed from the recent and previous head and shoulder price formations.

EURUSD gave off another Bullish Pin Bar at trend-line support after the initial one which is shown in the chart above. EURUSD is in no doubt bullish mood and though the trade rooms previous bullish entries had hit TP, we still look for new bullish entries on retracements.

NZDCHF chart shows a pair which has broken through trend-line. Though we have a counter trend Pin Bar at the moment which could move the pair higher in a corrective buy off, more sustainable entries would be sort as the pair buys corrective into 0.8750 area.

After NZDJPY made a bullish break of its trendline, bias on the pair changed to bullish. And there had been two good possible entries. We still buy on any decent retrace into this pair.

Take advantage of my promotional 50% price Slash to enroll for my Price Action Course or a Subscription to my Trade Room or Mentor Programme to experience the simplicity of trading Price Action with me.

EURNZD has shown a reluctance for the recent bullishness to continue. We now have a the formation of a head and shoulder, with the second shoulder showing Pin bar rejection candles. It this setup pulls off, it still could be contained within the symmetric triangle formed from the recent and previous head and shoulder price formations.

EURUSD gave off another Bullish Pin Bar at trend-line support after the initial one which is shown in the chart above. EURUSD is in no doubt bullish mood and though the trade rooms previous bullish entries had hit TP, we still look for new bullish entries on retracements.

NZDCHF chart shows a pair which has broken through trend-line. Though we have a counter trend Pin Bar at the moment which could move the pair higher in a corrective buy off, more sustainable entries would be sort as the pair buys corrective into 0.8750 area.

After NZDJPY made a bullish break of its trendline, bias on the pair changed to bullish. And there had been two good possible entries. We still buy on any decent retrace into this pair.

Take advantage of my promotional 50% price Slash to enroll for my Price Action Course or a Subscription to my Trade Room or Mentor Programme to experience the simplicity of trading Price Action with me.

Sunday, November 24, 2013

Markets Price Action, The week ahead. AUDJPY AUDUSD CADCHF GBPAUD GBPCHF GBPUSD NZDCAD NZDCHF

AUDJPY chart above shows us a likely continuation of the bullish trend that emered after price hit a double bottom at about 5 and 27th August 2013. Its always safer to go with the major trend. If we get a reasonable setup on this pair in the coming week, we would buy into the pair. The pair currently trades just above a Support.

AUDUSD has given off a bearish break changing our bias on the pair. We had expected the pair to bull from the Previous support but it has failed to push the pair significantly higher. A corrective bullish pullback is expected still before any new bearish entries can be made.

CADCHF is clearly a bearish market with new entries made each time it swings. The current move on this pair could yet break the recent lows.

GBPAUD has failed to resume a new bearish trend as had been expected. But good enough, there was no Trade setup to warrant any bearish entry and with break of the previous high, the bullish trend resumes. but like before, we still shall wait for price to sell corrective into our mapped support zones.

GBPCHF has closed with a fakey Price action trade Setup after the initial rejection of the higher prices at its key resistance zone. The trade made new bearish entries on this setup and we look to the pair falling into the first mapped support zone. New bullish entries could also be made at those points.

GBPUSD looks to be trapped within a horizontal consolidation. sell entries will be made as it faces rejection at the resistance zone while buy entries made at the support.

NZDCAD also looks to be trapped withing a horizontal consolidation. A buy entry could be taken if the dynamics are right.

NZDCHF is very close to the Trade Room's take profit, which also is the support zone for the bullish break. We could take a buy entry if the price action is right.

AUDUSD has given off a bearish break changing our bias on the pair. We had expected the pair to bull from the Previous support but it has failed to push the pair significantly higher. A corrective bullish pullback is expected still before any new bearish entries can be made.

CADCHF is clearly a bearish market with new entries made each time it swings. The current move on this pair could yet break the recent lows.

GBPAUD has failed to resume a new bearish trend as had been expected. But good enough, there was no Trade setup to warrant any bearish entry and with break of the previous high, the bullish trend resumes. but like before, we still shall wait for price to sell corrective into our mapped support zones.

GBPCHF has closed with a fakey Price action trade Setup after the initial rejection of the higher prices at its key resistance zone. The trade made new bearish entries on this setup and we look to the pair falling into the first mapped support zone. New bullish entries could also be made at those points.

GBPUSD looks to be trapped within a horizontal consolidation. sell entries will be made as it faces rejection at the resistance zone while buy entries made at the support.

NZDCAD also looks to be trapped withing a horizontal consolidation. A buy entry could be taken if the dynamics are right.

NZDCHF is very close to the Trade Room's take profit, which also is the support zone for the bullish break. We could take a buy entry if the price action is right.

Subscribe to:

Comments (Atom)