Take advantage of my promotional 50% price Slash to enroll for my Price Action Course or a free Subscription to my Trade Room or Mentor Programme to experience the simplicity of trading Price Action with me.

Get Currencies, Metals and Commodities Trade Signals, Analysis, Recommendations, Key Levels, Fund management, Broker Recommendation.

Showing posts with label NZDUSD. Show all posts

Showing posts with label NZDUSD. Show all posts

Sunday, May 4, 2014

NZDUSD SHOOTS HIGHER AFTER A COMBINATION OF A HIDDEN AND REGULAR DIVERGENCES

Take advantage of my promotional 50% price Slash to enroll for my Price Action Course or a free Subscription to my Trade Room or Mentor Programme to experience the simplicity of trading Price Action with me.

Sunday, March 16, 2014

Markets Price Action and Trade Setups: THE WEEK AHEAD March 17 - March 21 , 2014. USDCAD, NZDUSD, NZDJPY, GBPUSD, EURAUD,

EURAUD bounced off resistance and looks likely to bounce again, off the support as indicated above. A Pin bar at that zone would be the trigger.

GBPUSD triggered for more bullishness at the close of trading on Friday and this scenario should propel the pair higher in the new week.

NZDJPY is set to trade lower within this week as price hit resistance and gave off a outside bar in the process.

NZDUSD has hit a critical point in its recent bullishness. Price could set-off lower early in the week.

USDCAD still hovers around its resistance zone as price hesitates to break through. Given this scenario, It is expected that the bears would have an upper hand at this zone.

Take advantage of my promotional 50% price Slash to enroll for my Price Action Course or a free Subscription to my Trade Room or Mentor Programme to experience the simplicity of trading Price Action with me.

Free Signal Service:

Fee: $0

Duration: for life

send me an email for detail on this

ahizechris@gmail.com

or skype :christian.ahize

GBPUSD triggered for more bullishness at the close of trading on Friday and this scenario should propel the pair higher in the new week.

NZDJPY is set to trade lower within this week as price hit resistance and gave off a outside bar in the process.

NZDUSD has hit a critical point in its recent bullishness. Price could set-off lower early in the week.

USDCAD still hovers around its resistance zone as price hesitates to break through. Given this scenario, It is expected that the bears would have an upper hand at this zone.

Take advantage of my promotional 50% price Slash to enroll for my Price Action Course or a free Subscription to my Trade Room or Mentor Programme to experience the simplicity of trading Price Action with me.

Free Signal Service:

Fee: $0

Duration: for life

send me an email for detail on this

ahizechris@gmail.com

or skype :christian.ahize

Sunday, January 26, 2014

Markets Price Action and Formations: THE WEEK AHEAD JAN 27 - 31 2014. EURJPY EURNZD GBPCHF GBPJPY NZDCHF NZDUSD

EURJPY appears to be offloading some of its over bought pressure. It is important to note that the recent rally of the jpy could even get stronger given that the move has triggered from a head and shoulder formation. We are yet to get a confirmatory price action confirmatory setup to go with the formation and if we fail to get it until price hits the horizontal/trendline support, the more dominant bullish trend should then continue.

Last week, I had mentioned that the EURNZD was still within its bullish trend as price fell into its bullish entry zone. The trade room made bullish entries based on the setup and we are currently over 300pips up as we approach our conservative TP.

GBPCHF has just broken through our bullish trendlines as its corrective sell-off seem to be flagging a change in trend. However, we wont be moved into any actions on this pair just yet until the trend clears out. We still carry a bullish bias on this pair as we wait for prices to offer opportunities to trade into them.

The NZDCHF has continued in its more dominant bearish trend after a corrective sell-off on the head and shoulder price formation as indicated above. Price on this pair should continue to fall lower in the coming week

NZDUSD is trapped within a range but has been offering reasonable trade setups in the range. At the moment, we still await a bullish entry setup from the head and shoulder formed at range support.

Take advantage of my promotional 50% price Slash to enroll for my Price Action Course or a free Subscription to my Trade Room or Mentor Programme to experience the simplicity of trading Price Action with me.

Free Signal Service:

Fee: $0

Duration: for life

send me an email for detail on this

ahizechris@gmail.com

or skype :christian.ahize

Last week, I had mentioned that the EURNZD was still within its bullish trend as price fell into its bullish entry zone. The trade room made bullish entries based on the setup and we are currently over 300pips up as we approach our conservative TP.

The NZDCHF has continued in its more dominant bearish trend after a corrective sell-off on the head and shoulder price formation as indicated above. Price on this pair should continue to fall lower in the coming week

NZDUSD is trapped within a range but has been offering reasonable trade setups in the range. At the moment, we still await a bullish entry setup from the head and shoulder formed at range support.

Take advantage of my promotional 50% price Slash to enroll for my Price Action Course or a free Subscription to my Trade Room or Mentor Programme to experience the simplicity of trading Price Action with me.

Free Signal Service:

Fee: $0

Duration: for life

send me an email for detail on this

ahizechris@gmail.com

or skype :christian.ahize

Sunday, January 19, 2014

Markets Price Action and Formations: THE WEEK AHEAD JAN 20 - 24 2014. EURAUD EURNZD EURUSD GBPCHF NZDUSD

EURAUD remains bullish as price continues to soar after brief retraces. This bullish bias remains in the comming week as we would be looking to buy into the up trend if price falls into our critical bullish entry zones between 1.5000 - 1.5200.

EURNZD looks set to continue in its more dominant bullish trend after price gave off a Pin bar as it fell into its bullish entry zone. Friday's bar further proves this as it took out the stops of traders who may have gone short based on the Pin bar of the previous day. 1.6700 is the projected conservative take profit zone.

EURUSD now approaches it Bullish entry zone. Entries could be made with a pending order or for the less aggressive trading, after the formation of a significant Trade Setup.

GBPCHF bounced strongly off its bullish entry point maintaining its bullish trend.

NZDUSD is a few pips away from its bullish entry zone. The trend on this pair remains bullish and buyers should find this zone significantly interesting for placement of buy orders. The less aggressive trader will probably wait for a trade setup at this zone.

EURNZD looks set to continue in its more dominant bullish trend after price gave off a Pin bar as it fell into its bullish entry zone. Friday's bar further proves this as it took out the stops of traders who may have gone short based on the Pin bar of the previous day. 1.6700 is the projected conservative take profit zone.

EURUSD now approaches it Bullish entry zone. Entries could be made with a pending order or for the less aggressive trading, after the formation of a significant Trade Setup.

GBPCHF bounced strongly off its bullish entry point maintaining its bullish trend.

NZDUSD is a few pips away from its bullish entry zone. The trend on this pair remains bullish and buyers should find this zone significantly interesting for placement of buy orders. The less aggressive trader will probably wait for a trade setup at this zone.

Sunday, January 12, 2014

Markets Price Action and Formations: THE WEEK AHEAD JAN 13 - 17 2014. NZDUSD EURAUD EURJPY EURUSD GBPUSD GBPNZD

NZDUSD gave bounced off its support/Entry Zone as buyers jumped in at the chance to move long with the pair in a 1, 2, 3 triggered bullish price formation. The 123 price formation/price action trade setups give the savvy price Action trader an edge in making market decisions. 0.8511 is the key target for the expected bullish move.

EURAUD is still very much in an uptrend though there now is significant threat to its continuation after price failed to continue lonng after hitting the bullish entry zone. A break below the minor support would initiate a possible change in trend.

EURJPY still looks significantly bullish as price broke through and still trades above the recommended entry zone. Price should continue long in the coming week.

The euro has bounced off its support/bullish entry point following a 1 2 3 price formation it gave off at the formation of the IPB (Inside Pin Bar) at about December 2014. The CPR (Closing Price reversal Price Action setup now sets the tone for a resumption of the more dominant bullish trend.

GBPNZD faced support as it traded into its bullish entry zone (My entry zones are determined by the breakout point of a previous 1 2 3 price formation). Price is expected to resume another bullish run based on this. Further more, price also broke out from the cluster of inside bars at that zone.

I have maintained that the GBPUSD is bullish with no sign yet of it slowing down yet. Price has once again bounced off support/entry zone, setting up even another 1 2 3 formation and a break of the entry trigger at the tip of the recent pin bar would set the pair up for another leg of the bullish run.

Take advantage of my promotional 50% price Slash to enroll for my Price Action Course or a Subscription to my Trade Room or Mentor Programme to experience the simplicity of trading Price Action with me.

EURAUD is still very much in an uptrend though there now is significant threat to its continuation after price failed to continue lonng after hitting the bullish entry zone. A break below the minor support would initiate a possible change in trend.

EURJPY still looks significantly bullish as price broke through and still trades above the recommended entry zone. Price should continue long in the coming week.

The euro has bounced off its support/bullish entry point following a 1 2 3 price formation it gave off at the formation of the IPB (Inside Pin Bar) at about December 2014. The CPR (Closing Price reversal Price Action setup now sets the tone for a resumption of the more dominant bullish trend.

GBPNZD faced support as it traded into its bullish entry zone (My entry zones are determined by the breakout point of a previous 1 2 3 price formation). Price is expected to resume another bullish run based on this. Further more, price also broke out from the cluster of inside bars at that zone.

I have maintained that the GBPUSD is bullish with no sign yet of it slowing down yet. Price has once again bounced off support/entry zone, setting up even another 1 2 3 formation and a break of the entry trigger at the tip of the recent pin bar would set the pair up for another leg of the bullish run.

Take advantage of my promotional 50% price Slash to enroll for my Price Action Course or a Subscription to my Trade Room or Mentor Programme to experience the simplicity of trading Price Action with me.

Labels:

EURAUD,

EURJPY,

EURUSD,

GBPCHF,

GBPNZD,

GBPUSD,

NZDUSD,

The Week Ahead,

Trade Setup

Monday, December 16, 2013

Markets Price Action and Formations: THE WEEK AHEAD DEC 16 - 20, 2013. CADCHF NZDUSD NZDJPY GBPCAD

GBPCAD still is in a very bullish run, however, corrective sell offs are expected until about the key support at about the horizontal / trendline supports as indicated above.

NZDJPY: we still continue to look out for bullish entries on this pair. It currently shows a bullish continuation trade setup in the Inside Bar it presents at the moment.

NZDUSD: There is a clear Pin Bar bullish continuation trade setup on this pair. The bias on the pair is slightly bullish and we expect price to attempt to break through the bearish trendline as shown on its chart above.

CADCHF: One of the greatest virtues in forex trading is patience. Those who were really patient with this pair based on my initial recommendation would have made up to 1:7 risk reward on its bearish trade setup we discussed a few weeks back. Expectations are now for a corrective bullish run.

Take advantage of my promotional 50% price Slash to enroll for my Price Action Course or a Subscription to my Trade Room or Mentor Programme to experience the simplicity of trading Price Action with me.

NZDJPY: we still continue to look out for bullish entries on this pair. It currently shows a bullish continuation trade setup in the Inside Bar it presents at the moment.

NZDUSD: There is a clear Pin Bar bullish continuation trade setup on this pair. The bias on the pair is slightly bullish and we expect price to attempt to break through the bearish trendline as shown on its chart above.

CADCHF: One of the greatest virtues in forex trading is patience. Those who were really patient with this pair based on my initial recommendation would have made up to 1:7 risk reward on its bearish trade setup we discussed a few weeks back. Expectations are now for a corrective bullish run.

Take advantage of my promotional 50% price Slash to enroll for my Price Action Course or a Subscription to my Trade Room or Mentor Programme to experience the simplicity of trading Price Action with me.

Sunday, November 17, 2013

The week ahead: Nov 18 - 22, 2013. AUDUSD, EURJPY, EURCAD, GBPAUD, GBPUSD, NZDJPY, NZDUSD.

AUDUSD as seen above is consolidating at about the support Zone we had mentioned at our last review. The expectation is for bulls to get in on this pair and push it higher from this zone. The trade room made an entry just before the close of the previous week and we expect the bulls to take control from here.

EURJPY as seen above has hit our projected TP Zone. The trade room made over 300pips from our entry. We now wait to see the reaction of the pair at this resistance zone.

EURCAD had triggered our buy entry as price fell within the support zone where bulls were expected to get back into the bullish ride, however, it did manage to pierce that zone-an indication that the bears were viciously selling off. The trade room did make a bullish entry but profits have been protected early since the pair also gave off a sell signal at the last recent resistance Zone. From this point, we are safe to hold onto the trade and hope price manages to push through this resistance. If it fails to and resumes bearish instead, The long tailed support should hold it for another round of bullish entries. Therefore we may be in for some Din Dong on this pair yet.

GBPAUD just above has been pushing long since the last time its review was made. We had pointed out that the trend had changed to bear but that a corrective buy-off was to be expected. Two zones were mapped out as possible reversal Zones and it has thus far broken through the first zone. If it sustains this break, It will most likely begin its sell off from the next resistance zone as indicated in the chart above. A price action sell signal at that zone should send prices down to the expected TP zone as indicated on the chart above.

GBPUSD has been consolidating within the Key resistance and Support Zone as indicated in its chart above. Its now moving bullishly towards its Key Resistance Zone. Pending Price Action, New bearish entries would be made at that zone. It may interest traders to know that the pair now carries a bearish bias following a failed break of the Support Zone.

NZDJPY: The last review we ran on the pair showed that we held a bullish bias on the pair and also made a bullish entry on it based on the over-all bias. The pair had given off a bullish Trade Signal as it delved into its Key Support Zone, setting off a Pin Bar Trade Setup. This was more like a bread and butter setup and was subsequently taken gleefully. As the pair now trades within its Resistance Zone, We wait to see what Price action Signal it gives off at this zone.

The NZDUSD chart tells an interesting story. The pair had made a failed attempt to continue its bullish trend from the area now marked as Key resistance. This changes the bias on this pair to bearish, and though the new move is bullish, it merely is a corrective bullish move. We are bullish on this pair but our TP is at the Key resistance zone and we would quickly make new bearish entries if we get a clear sell signal.

Take advantage of my promotional 50% price Slash to enroll for my Price Action Course or a Subscription to my Trade Room or Mentor Programme to experience the simplicity of trading Price Action with me.

EURJPY as seen above has hit our projected TP Zone. The trade room made over 300pips from our entry. We now wait to see the reaction of the pair at this resistance zone.

EURCAD had triggered our buy entry as price fell within the support zone where bulls were expected to get back into the bullish ride, however, it did manage to pierce that zone-an indication that the bears were viciously selling off. The trade room did make a bullish entry but profits have been protected early since the pair also gave off a sell signal at the last recent resistance Zone. From this point, we are safe to hold onto the trade and hope price manages to push through this resistance. If it fails to and resumes bearish instead, The long tailed support should hold it for another round of bullish entries. Therefore we may be in for some Din Dong on this pair yet.

GBPAUD just above has been pushing long since the last time its review was made. We had pointed out that the trend had changed to bear but that a corrective buy-off was to be expected. Two zones were mapped out as possible reversal Zones and it has thus far broken through the first zone. If it sustains this break, It will most likely begin its sell off from the next resistance zone as indicated in the chart above. A price action sell signal at that zone should send prices down to the expected TP zone as indicated on the chart above.

GBPUSD has been consolidating within the Key resistance and Support Zone as indicated in its chart above. Its now moving bullishly towards its Key Resistance Zone. Pending Price Action, New bearish entries would be made at that zone. It may interest traders to know that the pair now carries a bearish bias following a failed break of the Support Zone.

NZDJPY: The last review we ran on the pair showed that we held a bullish bias on the pair and also made a bullish entry on it based on the over-all bias. The pair had given off a bullish Trade Signal as it delved into its Key Support Zone, setting off a Pin Bar Trade Setup. This was more like a bread and butter setup and was subsequently taken gleefully. As the pair now trades within its Resistance Zone, We wait to see what Price action Signal it gives off at this zone.

The NZDUSD chart tells an interesting story. The pair had made a failed attempt to continue its bullish trend from the area now marked as Key resistance. This changes the bias on this pair to bearish, and though the new move is bullish, it merely is a corrective bullish move. We are bullish on this pair but our TP is at the Key resistance zone and we would quickly make new bearish entries if we get a clear sell signal.

Take advantage of my promotional 50% price Slash to enroll for my Price Action Course or a Subscription to my Trade Room or Mentor Programme to experience the simplicity of trading Price Action with me.

Thursday, August 29, 2013

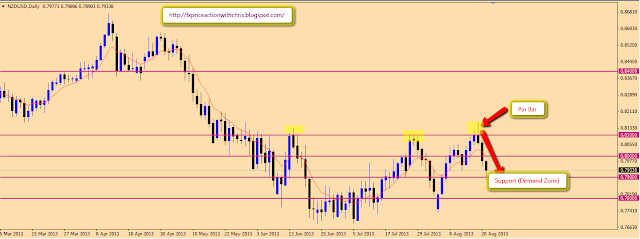

NZDUSD UPDATE: Bearish Pin Bar Trade Setup August 29, 2013

The Kiwi has been on a free fall since we discussed its Pin bar Price Action Trade Setup on August 19. It seemed to have hit a halt after yesterday's Pin bar but it should be noted that the pin bar Closed below the Psychological resistance hence, price was quickly rejected as it approached the dynamic resistance. The trade room quickly went short as soon as the day closed with price expected to reach for the next psychological support at 0.7700.

Subscribe to my Trade Room or my Mentor Programme or my Price Action Course to experience the simplicity of trading Price Action with me.

Wednesday, August 21, 2013

NZDUSD UPDATE: Bearish Pin Bar Trade Setup hits support August 21, 2013

Following the Pin Bar Trade Setup on the NZDUSD, which we have been following and subsequently traded after the break of Support, the pair has hit the projected psychological support area and our TP. It remains to be seen if the day will end with this rejection. If it does and we close the day with a Pin bar, We may then look to trade the new Setup.

Tuesday, August 20, 2013

NZDUSD PRICE ACTION: Bearish Pin Bar Trade Setup pulls Price lower, Breaks Psychological support. August 20, 2013

I had drawn attention to the Pin Bar Trade Setup formed on the Kiwi from my Trade Commentary yesterday. I recommended waiting for another failed break of the 0.8100 region. However instead, price moved quickly and we got a break of the underlying support at 0.8000, paving the way for further decline on the pair. The trade room is currently trading this break and price is expected to hit the next support zone at about 0.7900.

Subscribe to my Trade Room or my Mentor Programme or my Price Action Course to experience the simplicity of trading Price Action with me.

Monday, August 19, 2013

NZDUSD PRICE ACTION: Stranded Pin Bar Trade Setup, August 19. 2013.

Just like we had with the GBPCHF on the 15th of August, we also now have a stranded Pin bar Trade Setup on the Kiwi. For three days in succession, Price has failed to close above the 0.8100 Psychological level with todays candle forming a Pin bar, an obvious bearish Trade Setup. However, the setup still needs further verification and another failed close above the 0.8100 could be the trigger.

Subscribe to my Trade Room or my Mentor Programme or my Price Action Course to experience the simplicity of trading Price Action with me.

Sunday, August 4, 2013

NZDUSD PRICE ACTION: The week Ahead, August 4 - 9, 2013

We carry a bearish bias into the coming the week after the pair faced rejection as it approached its weekly Resistance Zone (0.8100) So many factors combined to push prices lower; the 21ema, the horizontal resistance line and the overall weekly trend, which was still quite bearish. The outside Bar Price Action Trade setup that ensured at the close of the week, should trigger further sell-off on the pair within the new week or even this month, however, the intersection point (Support/trend-line) could put a halt in its present bearishness. Attention is focused now on the daily and intra-day time frames for more bearish price Action Setups.

My Recommendation: Stay bearish

Subscribe to my Trade Room or my Mentor Programme or my Price Action Course to experience the simplicity of trading Price Action with me.

Subscribe to my Trade Room or my Mentor Programme or my Price Action Course to experience the simplicity of trading Price Action with me.

Friday, August 2, 2013

NZDUSD 4hr Price Action: Hidden Fakey with Pin Trade Setup. August 2, 2013

Most traders spend a lot of time feeling perplexed during the news but we really do not need be. Its still a matter of buying or selling isnt it? The Spike of news releases usually don't linger for more than 30minutes after which traders can go about their normal business of buying and selling, analyzing the charts again. Price Action technique allows you to do just that, since all you are concerned with are a few price Action patterns.

The NZDUSD has given off a significant price action trade setup just after the news release and in line with the recent bearish trend, we have a Hidden Fakey with Pin Price action Setup. The trade room is short now on this pair as we aim for about 1:2 risk reward.

The NZDUSD has given off a significant price action trade setup just after the news release and in line with the recent bearish trend, we have a Hidden Fakey with Pin Price action Setup. The trade room is short now on this pair as we aim for about 1:2 risk reward.

Wednesday, July 31, 2013

NZDUSD Price Action: Pin Bar at Support. July 31, 2013.

The recent pullback on the Kiwi has been halted at the demand Zone (0.7960) . A Pin bar price action Trade Setup at this zone is quite significant as buyers could further push the pair higher. Entry will be based on the intraday time frames pending significant price action inline with the expected bullish move. Targets will be at about the recent high.

Subscribe to my Trade Room or my Mentor Programme or my Price Action Course to experience the simplicity of trading Price Action with me.

Thursday, July 25, 2013

NZDUSD Price Action: Breaks out, remains bullish. July 25, 2013

"Break of supply Zone, further bullish bias" This was the headline to the last commentary I ran on the Kiwi and price has equally remained bullish, inline with expectations after a minor retracement into the zone I had considered as its new support. While we anticipate even further bullishness on this pair, it won't be out of place to get rotations back into its demand zones as indicated in the chart above. Bullish trade setups would be sort at about those zones if indeed the pair rotates lower.

Subscribe to my Trade Room or my Mentor Programme or my Price Action Course to experience the simplicity of trading Price Action with me.

Tuesday, July 23, 2013

NZDUSD Price Action: Break of Supply Zone. Further bullish bias. July 23 2013.

The Kiwi has broken through its supply zone after a failed Fakey with Pin Price Action Setup. A few of my students felt they had to trade that setup but I had cautioned against it and gave an extensive lesson on why not to in my advanced price action class. The Pin bar that was supposed to be the trigger had closed above a significant zone, which meant sellers couldn't push the price far into an area that would have triggered off a sell on the pair. Subsequently, the bulls still took charge and pushed prices above the Supply Zone and above the high of the supposed trigger Pin bar candle, hitting many stops of those who may have gone short on it. Following this scenario, fresh bullish intraday setups would be sort at about the New support.

Subscribe to my Trade Room or my Mentor Programme or my Price Action Course to experience the simplicity of trading Price Action with me.

Saturday, June 15, 2013

NZDUSD Price Action: Closing Price Reversal Trade Setup. Against Market Open June 16, 2013

The Kiwi shot a bit higher than my anticipated entry region, check June 12, 2013. However, it still had a significant price rejection at about that zone, filling our sell limit order and closing the day with a significant price action bearish setup. The potential reward on this trade was eventually cut down from a previous projection of about 200pips to just about 70pips. Hopefully, price will attempt to reach support at about 0.7990 and trigger our take profit. Buyers are expected to kick in at about that point as the pair finally seems to be shaking off its bearish nature.

I am currently running a 2week free Signal service. Visit my facebook official page to get involved in it.

Thursday, June 13, 2013

NZDUSD Price Action: Inside Bar Trade Setup. June 12, 2013

The bears on NZDUSD has been showing signs of slowing down in recent times, but its always adviseable to go with the dominant trend, in this case, bearish. The day closed with no significant moves as the entire trading was sequisted by the previous day's, leading to the formation of an Inside Bar trade setup. Price also now trades around key resistance and there is great possibilty that price would be rejected at about 0.8070 region, which should lead to the formation of a fakey setup. The trade room already has its pending sell order in place. However, this scenario would be completely changed if price were able to close above this key resistance zone.

I am currently running a 2week free Signal service. Visit my facebook official page to get involved in it.

Tuesday, June 4, 2013

NZDUSD Price Action: Outside Bar Trade Setup pulls lower and setup up an Inside Bar. June 4, 2013

I decided to do a follow up on the trade commentary from yesterday, to show how the Trade room got filled in on the Outside Bar Trade Setup. The entry was eventually made at about the Key Support Zone with stops below recent lows, target will be towards the zone marked as the key resistance zone.

Subscribe to my Trade Room or my Mentor Programme or my Price Action Course to experience the simplicity of trading Price Action with me.

Subscribe to my Trade Room or my Mentor Programme or my Price Action Course to experience the simplicity of trading Price Action with me.

Monday, June 3, 2013

NZDUSD Price Action: Outside Bar Trade Setup. June 3, 2013

In my last commentary on the Kiwi, I discussed the potential bullishness of the pair. Though price eventually pierced Support, it quickly was rejected in today's trading, leaving an Outside Bar Trade Setup in its wake. With this scenario, the pair now looks set to target higher prices in the coming days. though minor retracements into or just before Key Support is expected.

Subscribe to my Trade Room or my Mentor Programme or my Price Action Course to experience the simplicity of trading Price Action with me.

Subscribe to:

Posts (Atom)